Findings from the 2024 Playbook on how to communicate with your board.

Understanding the strategic value of IT in Business:

IronBridge's 2024 C-Suite playbook draws experiences and perspectives of numerous business and tech executives across the world's largest enterprises, showcasing research from top consulting organizations across the globe.

Many mature businesses lack the internal experience to evaluate technology architecture, and few can determine the valuation of technical debt. Yet, technology and its function in most modern businesses serve as the backbone of operations (upwards of 70%, depending on the industry) for longevity. Within this playbook, we delineate pivotal steps for steering a modern business into the year 2024. Our focus is on guiding the C-Suite's approach to technology, encompassing assessments of existing architecture, operational excellence, cybersecurity mitigation, and effective tech debt management.

Wait Here. Help Is On The Way.

Consider these findings:

Cybersecurity breach costs are continuing to soar. DDoS Cloud attacks loom as the top cyber concern, yet approximately one-third of organizations lack a formalized disaster recovery plan addressing challenges from critical infrastructure, data protection, data restoration, offsite backups, system reconstitution, configurations, and logs.

“Mega Breaches are increasing in number and scale and cost. The percentage of those reporting costs of $1 million or more for their worst breach in the past three years rose to 36% from 27% last year.” ref 1

Create a strong platform for growth:

To effectively manage technical debt, granular transparency is indispensable. Developing a detailed tech debt balance sheet enables accurate identification and assessment, providing an actionable roadmap for resolution. This aligns seamlessly with IronBridge's philosophy of engineering business transformations.

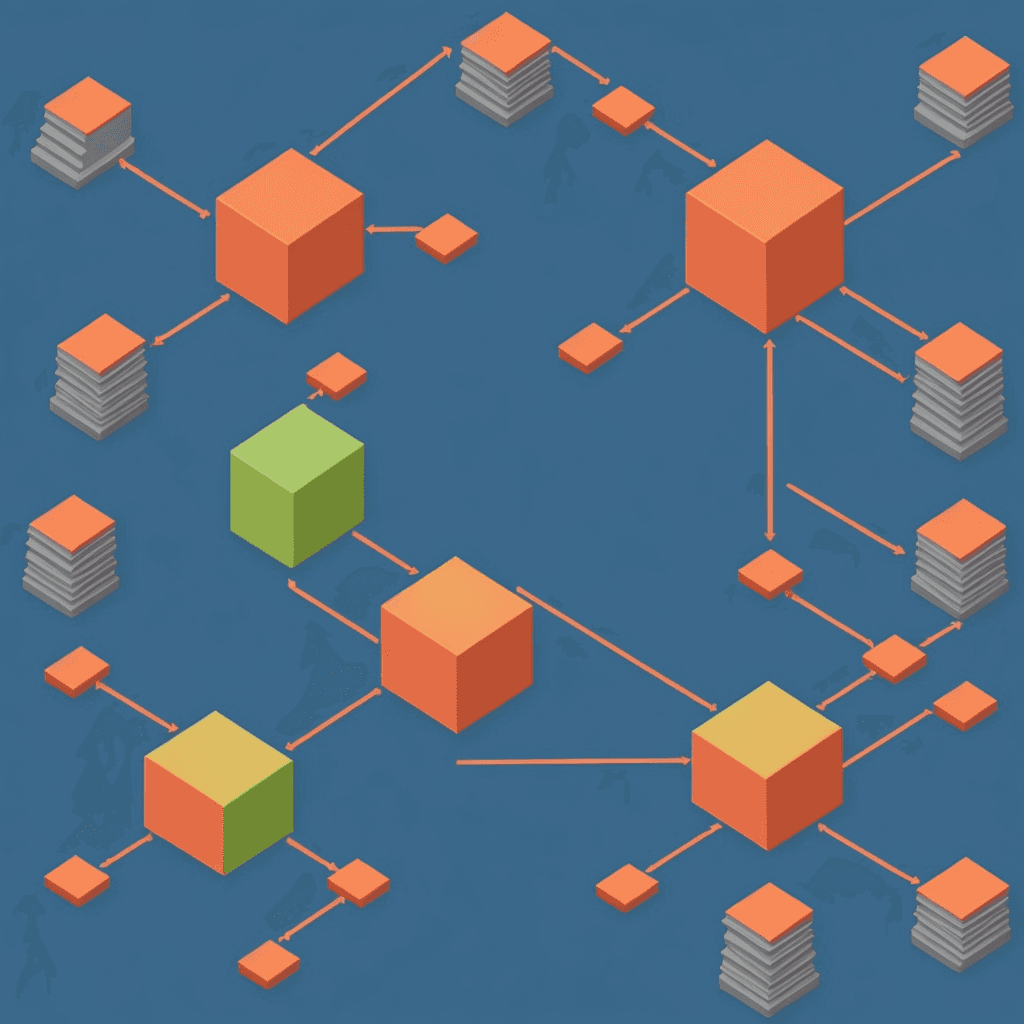

At IronBridge, our approach to business transformation starts breaking down the robust technology "machine." This hypothetical “machine” is broken down into three main components: Infrastructure, Data, and Development(DevSecOps). The machine signifies the operational components driving the business, be it ERP systems, Service Desk, Servers, Storage, Code Repositories, PLC Systems, or edge computing. It's about leveraging the horsepower and agility of this machine.

When considering a business transformation that involves re-building the current operating model it is important to think about forward compatibility with future technologies. Whether you want to deploy AI in your business, you want to securely use IoT data to increase visibility and productivity at your smart factory, or you want to secure your data pipelines with resilience. It starts with the power and agility of your “machine”.

IronBridge segments a “machine” into three fundamental components:

Infrastructure

Data

Development (DevSecOps)

Components of the "Machine":

Infrastructure: A cornerstone encompassing both on-premises and cloud deployments, providing the robust foundation on which your business applications rely.

Data: The lifeblood of your operations, spanning a spectrum from flat files to unstructured and structured data, fostering insights and decision-making.

Development (DevSecOps): The engine behind innovation, governing the development and deployment of code, ensuring continuous improvement and security. See Figure 1.0

Protect Your House:

Cybersecurity mitigation should be a top priority heading into 2024. With the shifting cybersecurity landscape, risk management goes beyond setting up a firewall. Simplifying tooling, leveraging cutting-edge technologies like generative AI, and establishing robust monitoring and reporting frameworks, in ordinance with the recent compliance laws from the SEC and Biden's executive order, form the core pillars of proactive cyber risk mitigation strategies. Below are an overview of the rules set out by the SEC on July 26, 2023:

The frequency and magnitude of mega breaches are on the rise, with a notable increase in the percentage reporting expenses exceeding $1 million for their most severe breach over the past three years, climbing from 27% to 36%.

Below are the steps in mitigating cybersecurity threats against your organization by modernizing and optimizing your current cybersecurity landscape. To achieve this you’ll need to:

Conduct a Security Assessment: Conduct regular risk assessments to identify vulnerabilities and potential threats. Swiftly address these issues by implementing necessary patches, updates, or security measures to effectively mitigate risks.

Provide Evidence of Compliance Steps: Document and maintain clear records of the steps taken to comply with compliance regulations. This documentation may include reports, audit trails, compliance documentation, and other relevant records that demonstrate the organization's commitment to meeting regulatory requirements.

Tool Rationalization: Assess the current suite of cybersecurity tools and identify redundancies, overlaps, or tools with limited functionality. Rationalize by selecting versatile solutions that cover multiple needs or integrate well with other tools to reduce complexity.

Unified Platforms: Consider adopting integrated platforms that offer comprehensive security functionalities. Unified platforms often consolidate various tools into a single interface, simplifying management and reducing the learning curve for cybersecurity teams.

Automation and Orchestration: Implement automation and orchestration tools that unify processes and workflows across different security tools. This integration reduces manual intervention, enhances response times, and ensures a cohesive security strategy.

In 2024, AI threat detection tools like Nvidia's "Morpheus" revolutionize monitoring by drastically reducing incident detection times from weeks to minutes, fortifying cybersecurity defenses with faster threat identification and neutralization.

Regular Re-Evaluation: Continuously re-assess the effectiveness and relevance of cybersecurity tools. Regular evaluations help identify obsolete tools or those that no longer align with the company's security objectives.

Modernize Your Infrastructure:

Infrastructure stands as a pivotal component in navigating the technology landscape of 2024, encompassing more than mere physical resources. Consider the following key components to address within your infrastructure:

Security and Compliance: Prioritize robust security measures and ensure compliance with evolving regulations to fortify your systems against potential threats.

Networking and DNS: Optimize network configurations and Domain Name Service for seamless connectivity and efficient data flow.

Servers, Storage, and Backup: Evaluate the scalability and resilience of your servers, storage capacity, and backup systems to accommodate growing data needs while ensuring swift recovery in case of any mishaps.

Monitoring and Management: Implement advanced monitoring tools for proactive detection of potential issues and streamline management processes for efficient system oversight.

Before diving into large-scale technology transformations, it's critical to comprehensively understand your existing infrastructure. This understanding serves as the bridge between your present and envisioned future states—a transformative journey to have meaningful impact on your bottom-line.

Remember, it's not just about embracing the latest technologies; it's about ensuring your infrastructure is not just upgraded but adaptable enough to support accelerated computing demands.

Prioritize Data Governance:

As you steer towards 2024, data governance emerges as a pivotal strategic asset for your organization, reflecting the transformative potential of data in shaping operations and fostering competitive advantages. Prioritizing data governance drives operational enhancements, supply optimization, and insightful, data-driven strategies crucial for maintaining an edge in dynamic markets. This strategic emphasis ensures compliance while harnessing data as a lever for sustained growth.

In the realm of data-driven organizations, agility in data accessibility and processing is paramount. Many businesses face challenges with siloed data across various applications, resulting in slow access and restricted insights. Waiting for data to conform to predefined structures in warehouses impedes rapid insights. Amidst this, accommodating new, diverse data sets becomes cumbersome. The question then becomes: How can organizations swiftly process and access diverse data sets, deriving insights without delay?

Addressing the Boardroom:

Assess Your Terrain: Are you where you want to be?

Examine your current system, deploy assessments, and stress tests—do the results align with your envisioned technological future? Establish the road-map from your current state to your future state. Aim to be proactively engaging with your team on how to mitigate risks and optimize performance.

Topic of Conversation: Technology

Is technology a regular agenda item in your boardroom discussions? Do these discussions encompass not only risk but also strategic initiatives driving business growth? Recognize that security underpins every facet of the organization's operations—finance, development, HR, and beyond. Elevate the conversation to emphasize how technology initiatives fuel revenue growth and business advancement.

Think Business, Think Technology: They're Inseparable

Business and technology aren't separate entities; they're interconnected. It's time for the C-suite to unite them. Embrace technology as an intrinsic part of the business, envisioning every aspect—financial records, proprietary research, customer data—secured against unauthorized access. Protecting the brand and fostering innovations through cybersecurity are keystones for growth and sustainability.

Noah Shiffman

Partner, Cloud Strategy

noah.shiffman@ironbridgeadvisers.com

Whether you are just getting started or already knee-deep in a multi-year strategy IT transformation the focal points featured within this report are adaptable to your timeline. IronBridge fills a crucial gap in the middle market, offering big four services at a price they won't touch.

Our team at IronBridge comprises top-tier talent drawn from Fortune 500 companies and Big Four consultancies, specializing in technology valuation, transformation, and seamless integration. What sets us apart is our track record closing deals and our unwavering commitment to ensuring transformations yield real returns.

Our Mission is clear: safeguard your assets and amplify your profits.

References & Disclosure:

References:

1) PricewaterhouseCoopers. “The C-Suite Playbook: Putting Security at the Epicenter of Innovation.” PwC, www.pwc.com/gr/en/publications/specific-to-all-industries-index/global-digital-trust-insights.html. Accessed 3 Nov. 2023.

2) Sarrazin, Hugo, and Andy West. “Understanding the Strategic Value of IT in M&A | McKinsey.” Www.mckinsey.com, 1 Jan. 2011, www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/understanding-the-strategic-value-of-it-in-m-and-38a.

3) MIT Technology Review, Databricks. Network Automation Efficiency, Resilience, and the Pathway to 5G Produced in Partnership with CIO Vision 2025: Bridging the Gap between BI and AI Global CIO Survey on AI Adoption by 2025. https://www.databricks.com/wp-content/uploads/2022/09/cio-vision-2025-final.pdf

4) https://developer.nvidia.com/morpheus-cybersecurity

5) “The Executive’s Guide to Data, Analytics and AI Transformation, Part 1: A Blueprint for Modernization.” Databricks, 28 Mar. 2023, www.databricks.com/blog/2023/03/28/executives-guide-data-analytics-and-ai-transformation-part-1.html. Accessed 20 Nov. 2023.

6) Bahreini, Dariush , et al. “Why Large M&a Deals Fail | McKinsey.” Www.mckinsey.com, 5 Aug. 2019, www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/done-deal-why-many-large-transactions-fail-to-cross-the-finish-line. Accessed 20 Mar. 2023.

7) Christofferson, Scott A., et al. “Where Mergers Go Wrong | McKinsey.” Www.mckinsey.com, 1 May 2004, www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/where-mergers-go-wrong. Accessed 20 June 2023.

Disclosure:

The above list is not an exhaustive compilation of all the actions that should be taken or capabilities deployed. Additional measures and leading practices may also be required to determine protection and compliance with associated regulatory bodies depending on location and industry related to business disclosures.